In 2013, the website MtGox.com was the largest bitcoin intermediary and exchange in the world, handling a staggering 70% of all bitcoin transactions. By February of 2014, the company was filing for bankruptcy protection.

If you visit the site today, you encounter this:

So what happened? How did the once dominant crypto site collapse? And if you had a crypto wallet with MtGox, is there any way to recover your bitcoin?

In this guide, we’ll answer both questions.

The website began not as a crypto trading platform, but as a way for fans of the card game Magic The Gathering to trade cards with each other. Founder Jed McCaleb bought the domain name www.mtgox.com and intended to create a website called “Magic The Gathering Online Exchange” (hence MTGOX).

Here’s what it looked like in August, 2007:

However, McCaleb abandoned the project after three months and moved on to other things. In 2009, he used the site for a new game he created called Far Wilds:

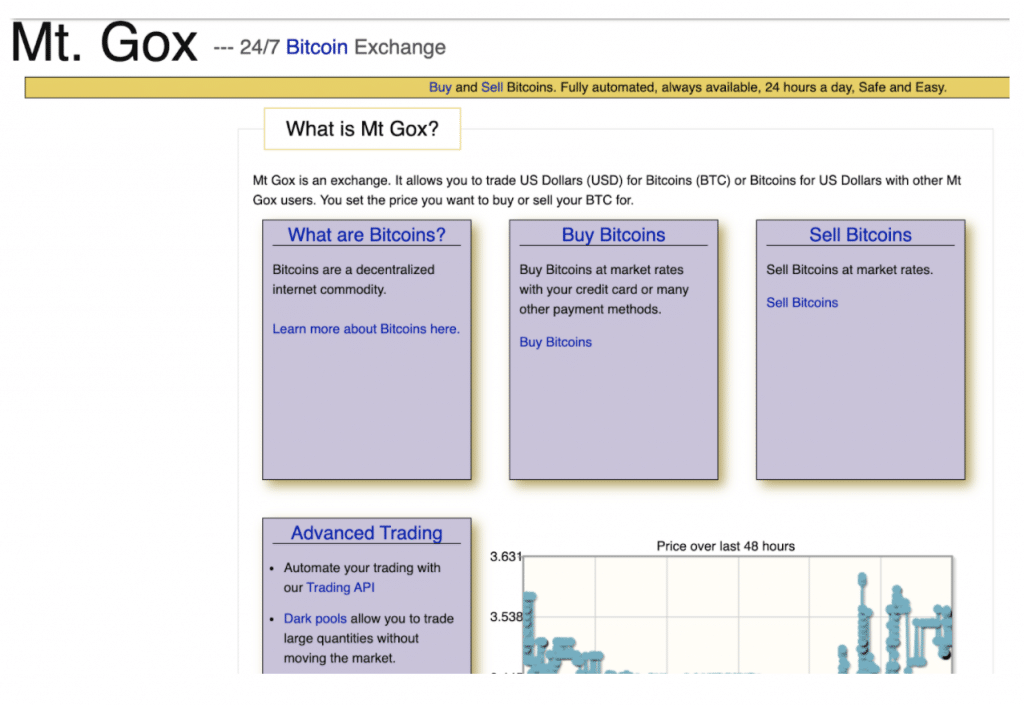

In 2010, McCaleb first read about bitcoin and realized that an exchange was needed to facilitate transactions between buyers and sellers. And so he turned his website into the crypto exchange that would soon dominate the bitcoin world. Here’s what an early version looked like:

In 2011, McCaleb sold the site to Mark Karpeles, a French developer living in Japan at the time. In just two short years, it would become the largest bitcoin exchange in the world.

Even after selling the site, McCaleb wasn’t done with cryptocurrency. Working alongside Arthur Britto, David Schwartz, and Ryan Fugger, he helped create Ripple, another form of digital currency.

After leaving Ripple, he went on to found Stellar in 2014, which is an open source blockchain payment system. As of this writing, McCaleb is still heavily involved with Stellar.

Now, before we talk about Mark Karpeles taking over Mt. Gox, we need to back up to just a few months before McCaleb sold the site. This sets the stage for many of the problems that happened under Karpeles.

According to a lawsuit filed against McCaleb, at least two security breaches occurred in early 2011, leading to a significant amount of bitcoin being stolen from users.

The lawsuit alleges that McCaleb didn’t refund users, announce the hack to the public, or fix the security problems. Instead, he simply sold the site and moved on.

McCaleb vigorously denies this, saying:

The idea that I was somehow to blame for the demise of Mt. Gox, three whole years after I had anything to do with the site, is completely ridiculous. The amount missing when Mark took over was relatively minor and he was fully aware of it.

Regardless, the problems didn’t stop with the initial security breach. On June 13, 2011, the site announced that 478 accounts had 25,000 bitcoin stolen from them. Two days later, a hacker by the name of cRazIeStinGeR announced that he had the entire user database for sale, which included all the usernames and passwords. Still the company didn’t take action.

The very next day, a flurry of unusual trading activity began, ultimately causing the exchange price of bitcoin to crash from a high of $17 to $0.01 per coin. Later in the day, someone released the database of usernames and passwords, compromising all 61,016 accounts. The company also confirmed that 2,000 bitcoin were stolen that day.

In response, Karpeles temporarily shut down the site for a week and disclosed the breach to users. It also worked to refund and roll back any fraudulent transactions. For the time being, things stabilized.

But the problems were really just beginning.

It was not a single event that doomed Mt. Gox, but rather a series of unfortunate events. In early May of 2013, CoinLab filed a $75 million lawsuit against the company. The two companies had partnered in February of that year, with CoinLab agreeing to process all of the North American transactions. The lawsuit alleged that Mt. Gox didn’t allow the company to transfer North American customers over to CoinLab.

Things went from bad to worse. On May 15, 2013, the United States Department Of Homeland Security issued a warrant against the company’s U.S. subsidiary account. Why? Because the company was not a licensed money transmitter in the United States and was violating money transfer laws. As a result, the government seized $5 million. In response, the company temporarily halted withdrawals in U.S. dollars.

In August of that year, the company released a press statement in which they admitted that they had “incurred significant losses” because they had prematurely credited accounts before actually receiving the funds from their bank.

The site continued to stumble. In November of 2013, Wired noted that customers were having to wait weeks, even months, before receiving withdrawal funds.

February of 2014 was the end of Mt. Gox.

On February 7, the site halted all withdrawals, stating the need to fix a significant software bug. For the next two weeks, Karpeles refused to give any indication of when users might be able to withdraw their funds.

On February 24, all trading was suspended. Hours later, the site itself was taken offline.

When the company filed for bankruptcy protection, they announced that they had lost nearly 750,000 customer bitcoins and 100,000 of their own. (Karpeles later explained that he had found 200,000 of the missing bitcoin in old-format wallets). They blamed hackers for the (remaining) missing bitcoins.

The company mired through several years of legal proceedings, navigating bankruptcy procedures as well as lawsuits from customers. In 2015, Karpeles was arrested by Japanese police and charged with a variety of crimes, including embezzlement and manipulating accounts.

In May of 2016, Mt. Gox creditors claimed that they were owed $2.4 trillion, but the firm overseeing the bankruptcy proceedings stated that there was only $91 million in assets that could be used to cover these claims.

In 2019 Mark Karpeles was convicted of tampering with financial records, but received a suspended 2.5 year sentence.

If you had bitcoin (or fiat funds) stored in a Mt. Gox wallet, is there any way to recover any of it?

If you have done nothing until now, then the answer appears to be “No”. This Frequently Asked Questions from the mtgoxinsolvency subreddit may help you understand why that is the case.

(Of course, these details can change quickly -- you might read about Zombie claims here -- especially notes referring to the “Z2” claims).

However, if you have paid attention to the news and you registered a claim before October 22, 2018, you may get some of your lost assets back from Mt. Gox.

How much? That depends on a few things.

A Russian law firm, ZP Legal, believes that they can recover 25% of the 850,000 bitcoins that were stolen from Mt. Gox. They will do this by pursuing legal action on behalf of the creditors against Russians believed to have received the stolen funds. In return, they will take a sizable portion of what’s recovered.

As of this writing, it’s not clear whether this plan of action will actually produce any results.

Another possibility involves a recent deal between CoinLab and those handling the Mt. Gox bankruptcy. If approved, the deal would allow creditors and investors to get an early, partial payout rather than waiting for a larger payout after all the legal proceedings have been handled.

Unfortunately, the best case in either scenario involves only a small portion of the bitcoin lost through Mt. Gox being recovered.

However, because the value of Bitcoin has soared roughly 80x since Mt Gox closed, (from around USD $600 / BTC in Feb 2014 to around $50,000 in March 2021), creditors may receive funds that were substantially larger than the 2014 value of their accounts.